Merry Christmas to everyone who observes and celebrates it! This period is a great time to reflect on a great year which is coming to an end, and smart forex traders are taking a closer look at their forex portfolios in order to conduct an annual overview of their performance, crunch numbers and determine where they need to improve to make the next year an even better one. Many global markets are closed for Christmas today which means very thin volumes will be encountered. Volatility is expected to be low, but that does not mean that there are no profitable trading set-ups for those who seek a little year-end boost to their performance.

The biggest story for many over the past few days is the correction in crypto currencies with Bitcoin related news and tweets clouding their trading terminals as well as social media accounts. While the sell-off at some point totalled over 40% which wiped more than $160 billion worth of value from the crypto market, there is more downside potential as the previous three Bitcoin corrections took it down by 93%, 86% and 72%. Michael Novogratz cancelled plans for his crypto fund stating that ‘We didn’t like market conditions and we wanted to re-evaluate what we’re doing. I look pretty smart pressing the pause button right now.’

The Asian trading session provided the fuel for the rest of the forex trading session. The Japanese market was the largest one open for business together with the Chinese one. While Japan will inject some volatility during the late evening and early morning tomorrow, China gave traders two key facts to consider when placing forex trades related to commodities. Yang Weimin from the Economic Policy Committee of the Communist Party noted that the Chinese economy could double over the next two years even with a growth rate of 6.3%. This can provide a floor for the Australian Dollar, the New Zealand Dollar as well as the Swiss Franc in 2018.

Looking for a late Christmas present? PaxForex offers forex traders its renown New Year Roulette! Spin the roulette for your gift and make sure you will have a great start into 2018. Join the growing family of profitable forex traders who call PaxForex their home. Open your account today and see why tens of thousands of forex traders prefer to earn their money at PaxForex.

In addition to the comments from Yang Weimin about doubling the GDP from 2010 levels not being a ‘huge barrier’ with a 6.3% expansion between 2018 -2020, an official from the People’s Bank of China suggested that local governments should be allowed to go bankrupt. According to the PBOC official this would help limit high borrowing by regional officials which has caused debt levels to surge in China. President Xi Jinping made financial stability a top priority for 2018. This will undoubtedly have an impact on the forex market. Here are three ways to ensure a great finish to 2017 with a Merry Christmas and three Japanese Yen presents.

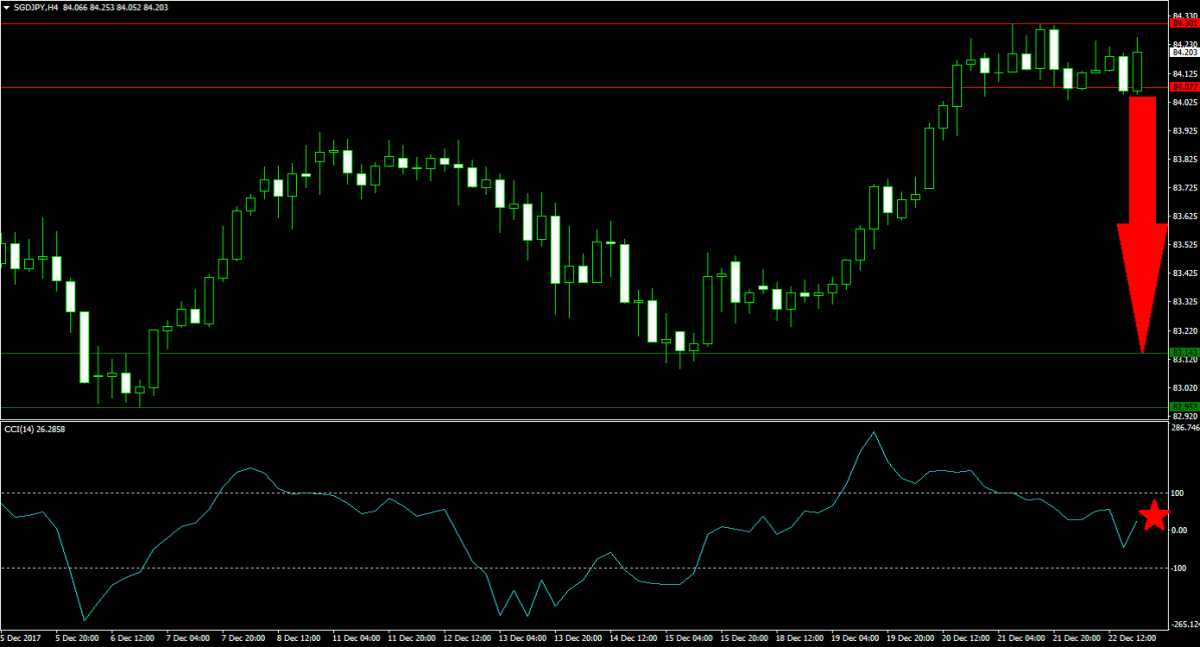

Forex Profit Set-Up #1; Sell SGDJPY - H4 Time-Frame

Staying with our Asian trading session inspire theme, the SGDJPY has depleted bullish momentum inside of its horizontal resistance area which rejected further upside. Price action is in the early stages of mounting a breakdown from where selling pressure is set to increase at an accelerated pressure. Adding a wave of better than expected economic data put of Japan is predicted to send the Japanese Yen into a strong finish for 2017. This currency pair has plenty of downside potential with limited upside risk and makes this a great short candidate.

The CCI has confirmed the loss of upside momentum and plunged through the 100 mark. This indicator is set to resume its move to the downside and a move below the 0 mark is predicted to invite more sell orders. Download your MT4 trading platform today, spin the wheel and enter this trade before the next leg lower materializes.

Forex Profit Set-Up #2; Sell NZDJPY - H4 Time-Frame

The NZDJPY is in a similar position as the SGDJPY, but at an earlier stage and with the commodity aspect associated with is as well. Chinese demand for commodities impacts the price and economies, like New Zealand, who are heavily dependent on commodity exports will see their currency fluctuate. This pair is depleting buying pressure inside of its horizontal resistance area from where a corrective phase is predicted to emerge. A breakdown below its ascending support level is likely to result in an aggressive move to the downside.

The CCI drifted from extreme overbought territory, above the 100 mark, into neutral territory. Forex traders should monitor this indicator for a breakdown below 0 which will complete the momentum shift from bullish to bearish. Open your PaxForex trading account and join our growing trading community of profitable and happy forex traders.

Forex Profit Set-Up #3; Buy CHFJPY - H4 Time-Frame

It is always smart to have a hedge in place which will protect your portfolio from unexpected moves. Today’s trades are centered around the Japanese Yen and a smart hedge for our short recommendations in our long position in the CHFJPY. This currency pair has just bounced higher off of the upper support level from its horizontal support area which is additionally being enforced by its ascending support level. More upside is possible which can take the CHFJPY back into its horizontal resistance area.

The CCI briefly dipped below the -100 mark which took it into extreme oversold conditions, but has quickly recovered. A breakout above 0 should further assist this currency pair in its advance. Subscribe to PaxForex Trading Recommendations as well as Fundamental Analysis in order to receive the most profitable trades directly from our expert analysts.

To receive new articles instantly Subscribe to updates.